Collection Schedule

Click here for the 2024 collection schedule

.png)

#CultureInArnprior

Learn all about the culture of Arnprior and the surrounding areas in this exciting speaker series!

Spring Registration

View and register for spring programs here.

Arnprior Market

Vendor applications are now open for the 2024 Arnprior Market. Click here to learn more.

News and Notices

View All

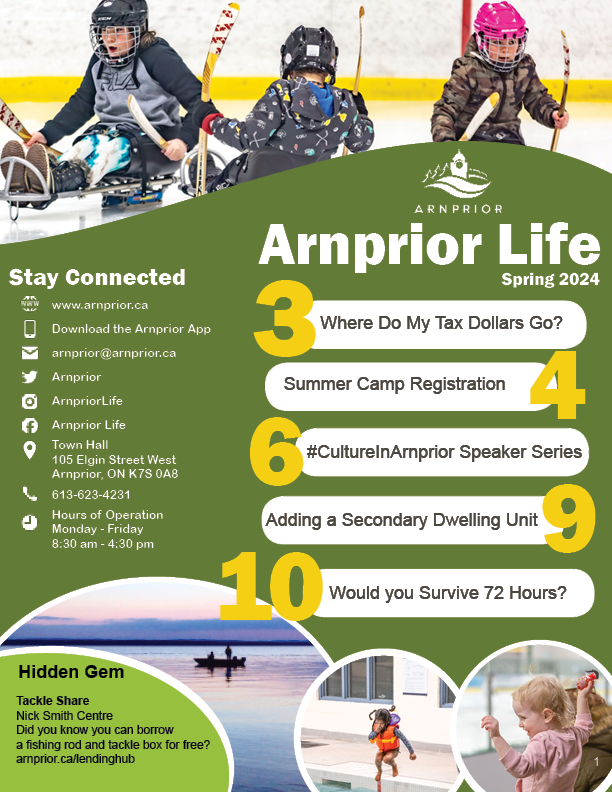

Arnprior Life is a quarterly publication that highlights all the Town has to offer. Click here to read the Spring edition.

Loading News Feed...

Connect With Us